Don’t let cash flow be a hurdle in your retail success!

Are you a retail business owner juggling between growth and cash flow? Don’t let cash flow hold you back when it comes to upgrading your POS and retail management system. ACCEO Retail-1 offers a unique and game-changing leasing program that can jumpstart your retail business and take your brands to places they have never been before!

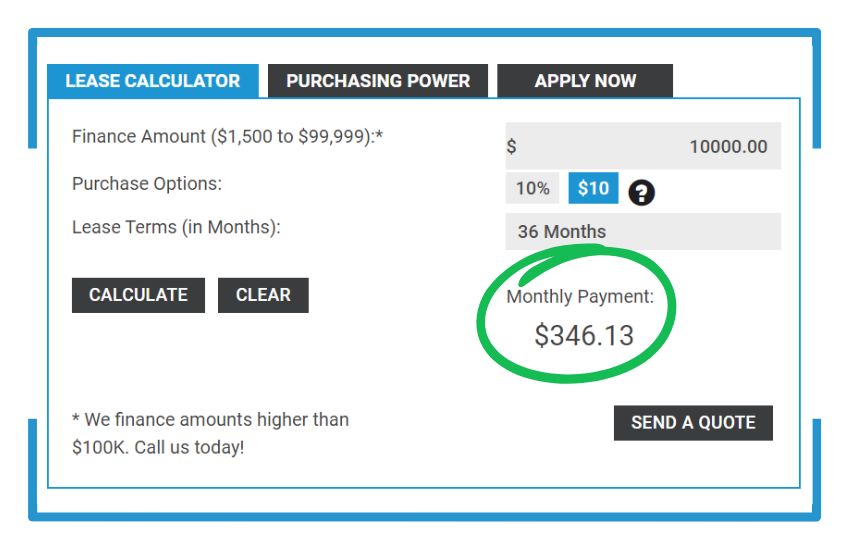

With ACCEO Retail-1 Leasing Program, you can lease amounts starting as low as $1,500 without any stringent financial qualifications or down payments. That’s right, get your lease approved in less than a day with complete peace of mind and reclaim access to the capital you need to invest in what really matters! With a powerhouse like ACCEO Retail-1 in your corner, you can manage every aspect of your retail business from a centralized location and synchronize digital and physical selling like never before without breaking the bank.

✓ Deduct full lease payments as business expenses, lowering your net cost

✓ Expense payments, avoid depreciation and keep equipment off balance sheet

✓ Pay sales tax over the lease term, instead of upfront

✓ No down payment requirement, 100% of the purchase price is financed

✓ Make payments according to your expected seasonal earnings

✓ Protection from equipment devaluation or obsolescence

✓ Quickly acquire new equipment as it is needed

Easily apply in just a few simple steps and we’ll take it from there. Our fast-track approvals have a record of getting leases approved in less than 15 minutes. Empower your retail business with a reliable and powerful retail management system that fuels your business growth, empowers your store associates, and unlocks future scalability. Say goodbye to paperwork nightmares and start welcoming loyal returning customers!

Don't wait. Ditch the cash crunch together!

Ready to take control and watch your retail dreams come true? Fill out the form, and let’s get started! Once we’ve received your interest, our leasing partner will reach out to answer all your questions, walk you through the process, and ensure you have the smoothest, most hassle-free leasing experience ever.

Remember, cash flow shouldn’t clip your wings. Soar with ACCEO Retail-1 Leasing Program. The sky’s the limit!

Frequently Asked Questions

How long does it take to get my lease approved?

We understand the importance of swift decisions for your business. Typically, our leasing process can approve your request in as little as 15 minutes.

What are the advantages of leasing in terms of accounting and taxes?

Leasing offers several accounting and tax benefits, including deductible lease payments, avoiding upfront sales taxes, and preserving capital and credit lines for operational needs.

What payment flexibility do you offer?

We provide flexible payment terms tailored to your business’s seasonal earnings, allowing you to control equipment turnover and costs effectively.

What leasing options are available, and how can they be customized?

We offer over 8 leasing options, customizable by our expert advisors to align with your growth and profit goals. Options include upgrading equipment, short-term contracts, and protection against devaluation.

How quickly can I acquire new equipment through leasing compared to traditional financing?

Leasing offers expedited acquisition, often approved within minutes, in contrast to banks’ longer response times, which can take days or even weeks.

Is leasing a viable option for businesses with credit issues?

Yes, leasing is often more accessible than loans and offers flexible terms, making it suitable for businesses facing credit challenges.

How does Equilease support businesses throughout the leasing process?

Our expert advisors collaborate closely with you to devise a flexible financing plan aligned with your objectives. With our extensive network of financial institutions, we secure financing quickly, allowing you to focus on managing your business effectively.